The IA Model Is Under Pressure From Every Direction

The tradeoffs you used to make don't work anymore.

For IA Firms

Your adjusters inspect. We write and QA. More files. Same team.

The tradeoffs you used to make don't work anymore.

They win on price and speed. You lose contracts trying to compete on both.

Desk teams, managers, QA staff. The costs don’t flex, but your volume does.

Tighter SLAs. Stricter guidelines. Lower fees. Same expectations.

You’re asking one person to inspect, document, write the estimate, handle compliance, negotiate, review, and manage the insured. That’s not a job description. That’s a setup for burnout and bottlenecks.

The best adjusters should be in the field closing files. Not grinding through Xactimate at midnight.

Case Study · Major Hail CAT · 9,000+ Claims

Our smoothest CAT response ever. Hit every SLA with a fraction of the staff we'd normally need.SVP Claims Operations — National IA Firm

Your top 20% already outperform the rest. With ClaimScale, five adjusters can deliver what fifteen used to. You keep your best people in the field. We handle the desk work.

Quality, speed, or price. Pick two. That used to be the tradeoff. Not anymore.

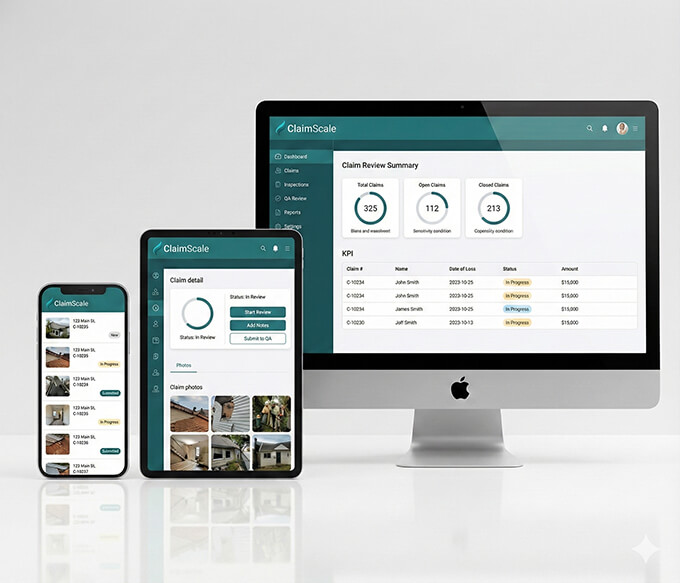

How It Works

Average turnaround: 8 hours. CAT surge capacity available.

Your adjuster completes the inspection and submits the scope (via FieldGuard or existing tools).

ClaimScale builds the estimate overnight. Dual-layer QA (AI + Human) before delivery.

By morning, it’s in your queue. Validated and ready for carrier submission.

All PII, photos, and estimates protected with SOC 2 and NAIC-aligned controls.

No fixed overhead. Scale up for CAT, scale down between storms. You only pay for closed files.

Every file passes dual-layer QA before it hits your desk. AI validation + human review reduces carriers rejections.

Field adjusters go from 5-6 files/day to 12-14. Same boots, different math.

We stay invisible. Your carrier relationships stay intact. We work in your systems.

Most inspection apps are clunky, crash-prone, and built by people who’ve never been on a roof. FieldGuard is different.

Built by an adjuster with 16,000 inspections. Intuitive. Fast. Works offline.

Your adjusters can use it, or submit scopes however they already do. But once they try FieldGuard, they won’t go back.

Security

Built to pass carrier vendor risk assessments.

Get Started

See your potential savings in 15 minutes. No prep required.